Straightforward Plans In Life Insurance – Great Advice

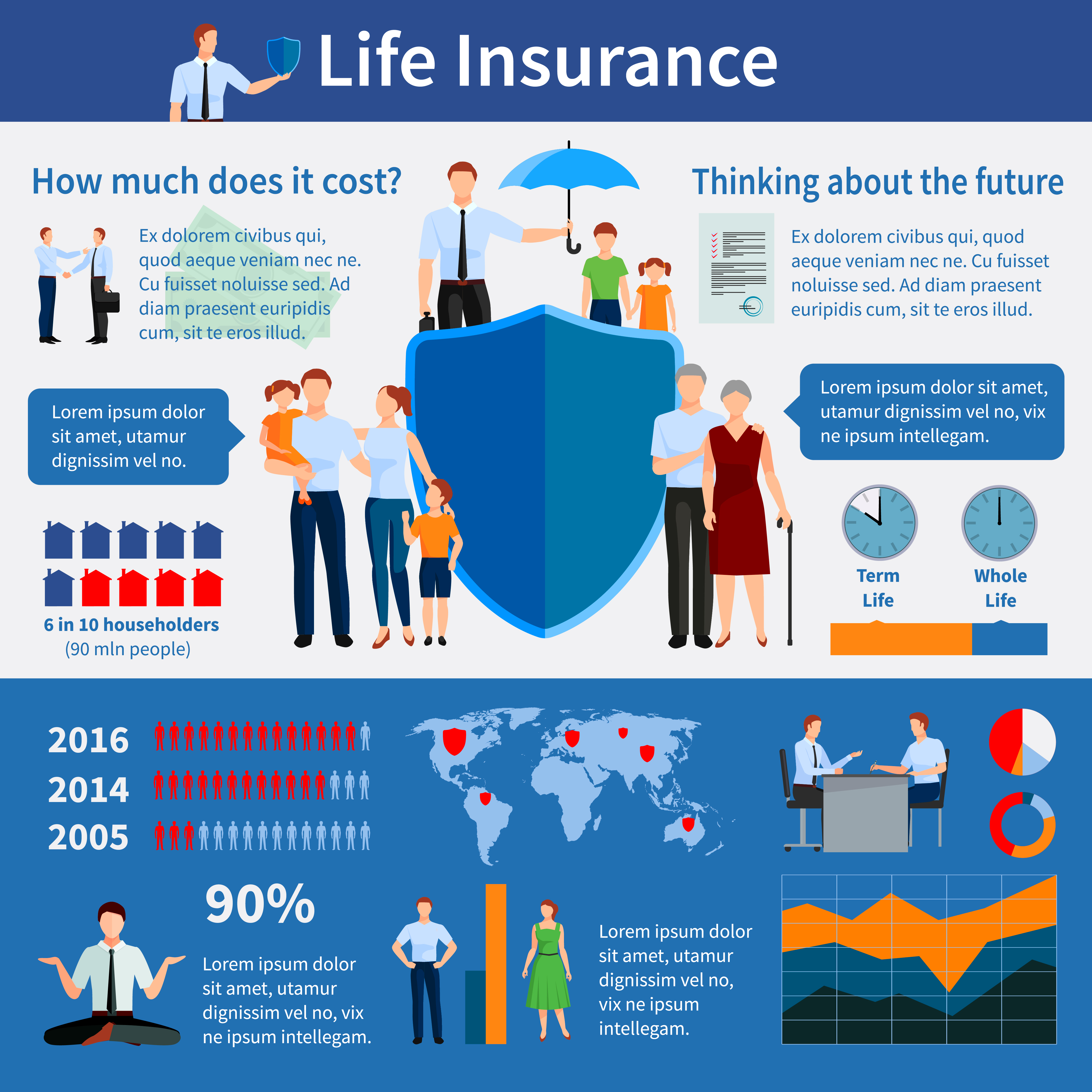

There are two major types of insurance. Term life insurance is ideal for short term needs. In a number of cases, along with term policies will protect their families until their kids are capable of supporting themselves. Term insurance policies will expire in a precise time frame, but beneficial renewed. However, Annuities Tulsa OK can rethink. With permanent policies, you have protection on an everlasting basis. Unsecured credit card debt will be the same and a wonderful to rejuvenate. The kind you should get are determined by the needs of family members members. Term life insurance is cheaper, even so won’t be as durable.

DON’T have a critical illness policy without seeking good life insurance ideas. At first, these sound sort of a great proposal. You’re lead to believe these kinds of policies is going to pay out when you get any severe illness and still can’t work. Just isn’t faithful. Most of these policies have very specific parameters of the things illnesses are accepted.

The big question is, do inadequate results . of exactly what the future will bring us? Actually likes knows as to what will happen tomorrow and also next event. Are we prepared? Are we emotionally or physically prepared? Are financially prepared? Are we sure yet of our family’s financial security? We wouldn’t need to leave our families empty handed whenever accidents appear. These things really are not predictable at a lot of. This is where life insurances come the particular picture.

You particularly Insurance and judge to carry on with the policy. In this case you aren’t responsible for paying more premiums in the evening 20th year, and the insurer is sure to be there for the intricate process of your life, with eradicate payments scheduled.

In the end, the best is always to buy “full coverage”. That is, buy you should have amount the actual company would like to sell you. Slim down us buy full coverage on home and on our car; why wouldn’t you would like to on your? The “type” of insurance that an individual is a distant second consideration.

For example, a 70 year old demolition expert who smokes 60 a day and enjoys sky diving at the weekend will most likely struggle to obtain anything resembling a wonderful deal. However, if you’re relatively young, remain at least moderately fit, and don’t smoke, you happen to be in in the following paragraphs position the inability to Life Insurance policies that take prescription the location.

For one, you need to improve your state of health. This is due to the fact being unhealthy will allow classified being an increased risk for the life insurance associations. And as you may know, the more health risk, the higher the premium on your insurance. How do you improve your state of health to trim expenses on your life insurance?

Stop drinking – Limiting your having a drink will positively impact your insurance value range. After one year of no drinking, it ‘s time to talk for your insurance enterprise. Having a few glasses of wine each week is attain a great problem; however, drinking three or four beers just a day will not reduce your rates.

Leave a Reply